Businesses in Liquidations

Buy business assets and stock below market value

Liquidation marks the end for the business, but the beginning of opportunity for buyers ready to acquire assets at compelling value. Our subscribers track these listings to

Secure high-value assets below replacement cost, be it plant, machinery, IP, stock, contracts, property

Avoid legacy liabilities & debt to cherry-pick value without inheriting risk

Move quickly on time-sensitive disposals to get the right deal at the right time

Real-time liquidation data gives you first-mover advantage in asset-rich distress situations. By becoming a member of Administration List, you can use our database to

Contact liquidators early and register for sale packs and asset lists

Identify assets worth acquiring by contacting insolvency practitioners directly

B eat auction competition by negotiating private purchases before public bidding

Benefits

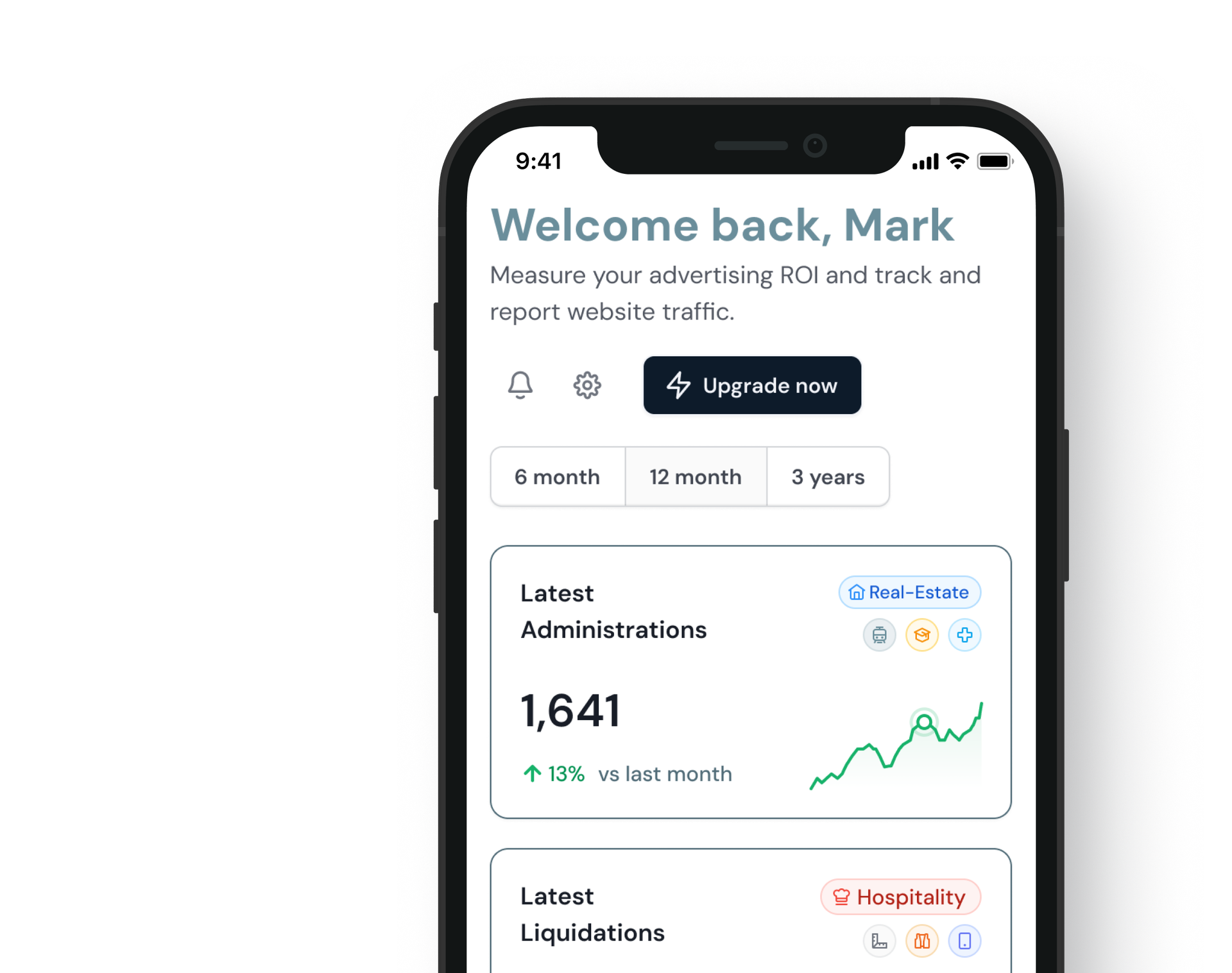

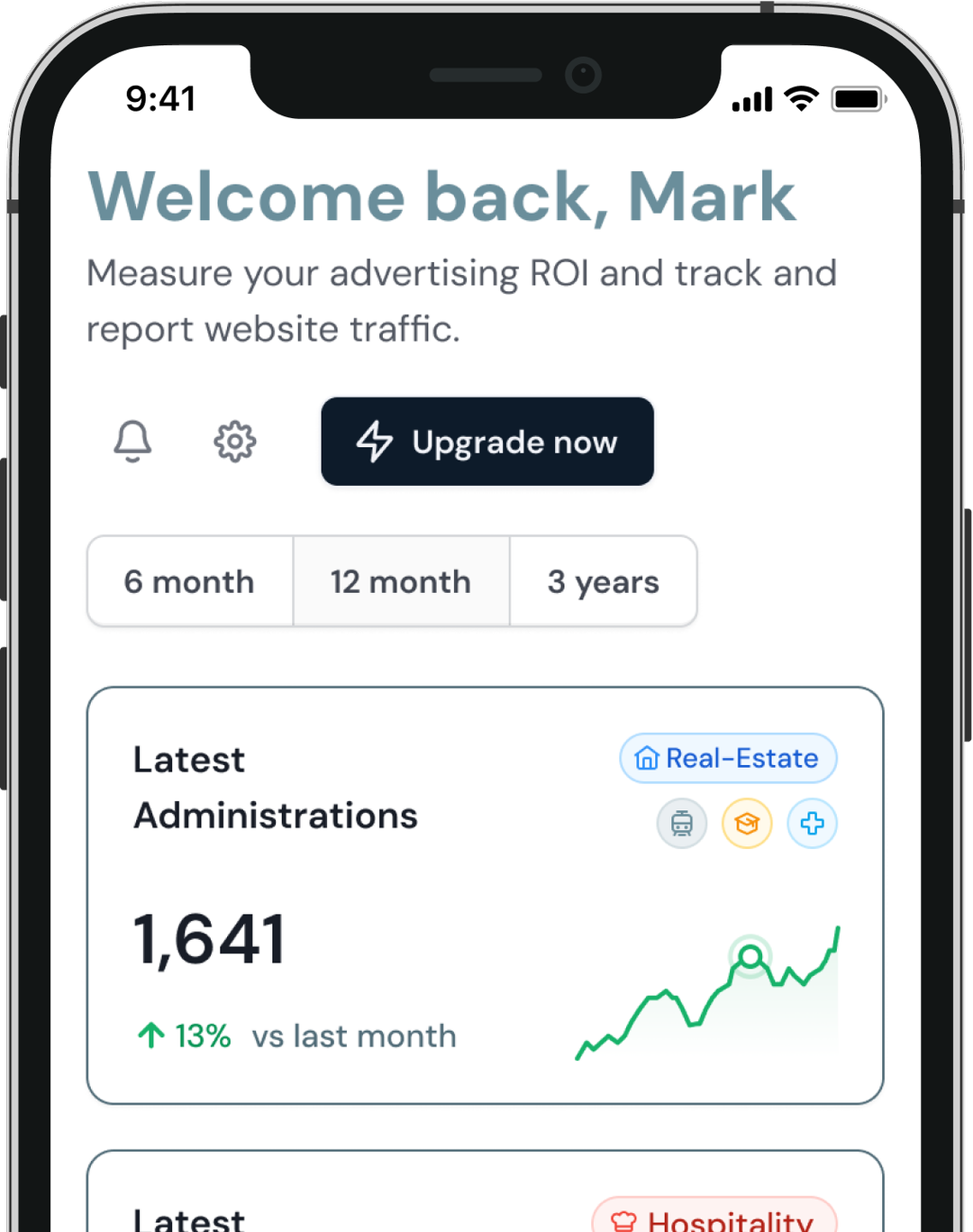

Real-time distressed business intelligence that helps you move faster, smarter, and

with confidence. Relied on by thousands of business buyers & investors since 2017.

Build tailored reports to track insights on UK distressed activity. Analyse trends and seize timely opportunities before anyone else.

Highlight specific businesses, business owners, and sector-wide insolvency activity with precision.

Get direct contact details for business owners and insolvency practitioners for early access to deals before they go public.

Our insolvency database is updated daily, ensuring accurate, up-to-date information always at your fingertips.

Build tailored reports to track insights on UK distressed activity. Analyse trends and seize timely opportunities before anyone else.

Highlight specific businesses, business owners, and sector-wide insolvency activity with precision.

Get direct contact details for business owners and insolvency practitioners for early access to deals before they go public.

Our insolvency database is updated daily, ensuring accurate, up-to-date information always at your fingertips.

Search

Find the latest distressed listings across the UK

Select regions

Add dates

Select status

Select the industries you're interested in

Get the latest market insights and exclusive insolvency resources delivered straight to your inbox.